Holiday shoppers showed unexpected stamina in November driving online sales up 8% over a year ago, according to Signifyd’s Holiday Season Pulse Tracker. But the top-line number disguised two key indications that consumers have not shaken off the recessionary vibe.

The November shopping frenzy, which was particularly evident during the Cyber Five weekend, relied heavily on discounts and buy now, pay later (BNPL) options — none-too-subtle signs that consumers are still feeling financially stressed.

We’ll need to wait until the wrapping paper is swept up and the holiday is tree tossed to the curb before we know to what extent generous deals bit into retailers’ profits. On the other side of the ledger, it could be that consumers pull back on spending in early 2024 as the holiday bill literally comes due — time and again in the case of BNPL.

“I do believe that the American consumer is stretching this holiday period and they’re justifying that by getting a discount or delaying payment,” Signifyd Chief Customer Officer J. Bennett said.

Beauty and cosmetics buyers doubled their use of discounts in November

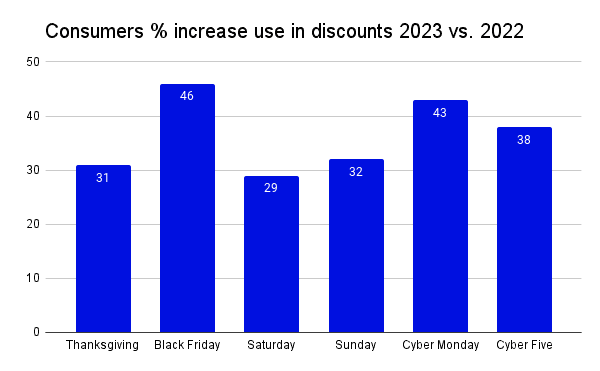

The number of online orders placed with discount codes rose 28% in November over a year ago, according to Signifyd data. Discount usage really took off during the traditional Cyber Five shopping festival, which stretches from Thanksgiving through Cyber Monday. Discounted online orders were up 38% year-over-year for the five days. On Black Friday alone the number of orders placed with a discount code shot up by 46%.

Some verticals most likely owed their positive Novembers to the discounts available in their categories. Sales of beauty and cosmetics for instance were 8% higher than November 2022 and the number of orders placed with a discount increased a whopping 102% over a year ago.

Fourth-quarter earnings will determine discount strategy success

How discounting to that extent will play out for merchants will become evident once they — and in some cases the public markets — analyze their fourth-quarter earnings.

“I think that the profitability of discount strategies has to be really on point for retailers to justify the level of discounting that they’re doing,” Bennett said. “Maybe they’re able to successfully differentiate between types of consumers — the ones who are willing to pay full price and ones who need a discount — and thus they’ve kind of maximized their curve. But that’s really hard to do.”

Whatever the case, consumers continue to find a way to spend in a time when dwindling pandemic nest eggs are reflected in declining savings rates. A look at November’s buy now, pay later activity provides some clues as to how consumers can keep going strong.

BNPL encouraged holiday shoppers to spend more

For November as a whole, BNPL orders were up 6%. But as the weeks raced closer to Christmas, the pace of BNPL purchases raced with them. In the last two weeks of the month, use of 2023’s version of the installment plan was up 12% over the same period in 2022. In the electronics category, which tends to include pricier items, BNPL purchases toward the end of the month were up 50% over a year ago.

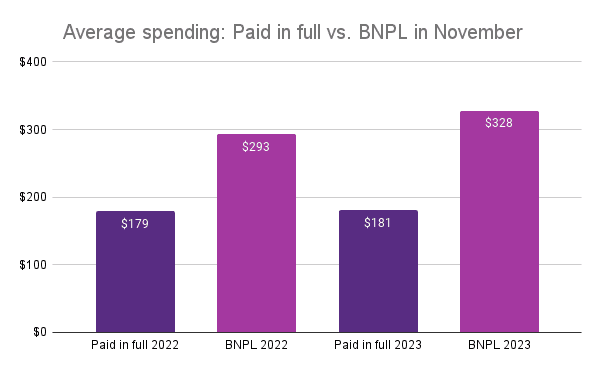

The ability to pay in installments prompted shoppers to spend more than their pay-as-you-go peers, Signifyd data shows. The average BNPL online order in November was $328 compared to the $181 per order spent by shoppers who paid in full.

That $328 represented a 12% increase in order value for BNPL purchases over November 2022. Meanwhile, the average order value for those who paid in one lump sum increased by only 1% over a year ago.

This week marks the holiday season’s free shipping day — a day distinctly defined, but also an unofficial reminder of the logistical deadline for receiving free or lower-cost shipping for packages meant to arrive by Christmas Day.

Will the discount and BNPL holiday hangover arrive in January?

For retailers who have pulled out all the stops on discounting, it will be interesting to see if the general upswing in sales can continue for the rest of the holiday season. And for consumers who have gone repeatedly to the BNPL option, it will be interesting to see just what they have left in them.

For now, both camps can look back at a November that saw positive growth in all the traditional gift verticals and a big boost in the grocery category, owing no doubt to high prices and holiday traditions.

November 2023 vs. November 2022 online sales by vertical

| All verticals | +8% |

| Alcohol, Tobacco & Cannabis | +30% |

| Grocery & Household Goods | +22% |

| Luxury Goods | +11% |

| Leisure & Outdoor | +9% |

| Beauty & Cosmetics | +8% |

| Apparel | +7% |

| Home Goods & Decor | +5% |

| Electronics | +4% |

While November outperformed Signifyd’s initial projection made before the holiday season started, the strong showing wasn’t enough to move projections for December or the entire holiday season — defined as the fourth quarter.

Sales in December will be 3% higher than last year, Signifyd’s models indicate. And Q4 is projected to finish up 5% over the final quarter of 2022.

Photo by Getty Images

Want to dig into more holiday data? Visit Signifyd’s Holiday Season Pulse Tracker.