It’s one of the most damaging things an online retailer can do: After a customer has chosen to buy a product, then painstakingly entered all their shipping and payment information, the retailer — being overly cautious about fraud — refuses the order.

This erroneous identification of a valid purchase as fraudulent is called a false decline — and can lead not only to the loss of that particular sale but to broader damages.

Your questions about false declines answered

What are false declines?

False declines are valid orders that a merchant declines for fear of fraud. The term “false decline” indicates that the order was erroneously flagged as fraudulent. Some merchants call these orders “insults,” an indication of the damage they can do to customer relationships.

What is the average false decline rate?

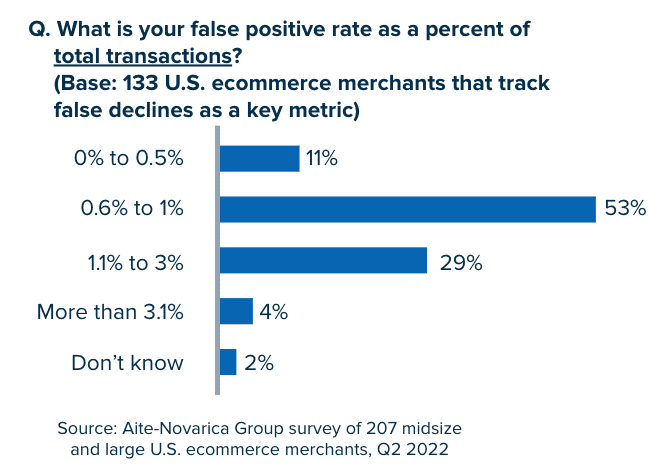

It’s tricky to get an accurate false decline rate, partly because only 64% of merchants track false decline rates, according to a merchant survey by the Aite-Novarica Group.

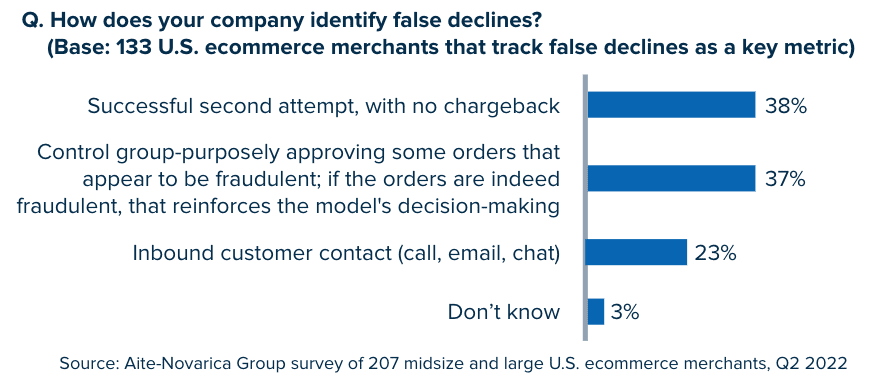

Those that do, use varying strategies for identifying false declines, such as an order that goes through on the second attempt and does not result in a chargeback; or a blocked order that is followed by a complaint to customer service. Some merchants purposely approve a small number of orders that appear fraudulent, as well, to test whether their systems are correctly identifying fraud.

Due to these complications, estimates of the false decline rate vary. For example, in the Aite-Novarica Group survey about one-third of ecommerce merchants estimated that more than 1% of their total transactions are false declines. Another estimate, based on a survey by the Merchant Risk Council, found that about 6% of all ecommerce transactions are rejected due to fraud suspicions, and of those, false declines are between 2% and 10%.

What causes false declines?

False declines arise in ecommerce for a number of reasons. Merchants that depend on manual review of orders, legacy rules-based systems or some combination leave themselves open to problems that newer AI-driven fraud protection systems were designed to avoid.

Those who turn to manual review with human agents to detect fraud leave themselves open to human error. Fraud teams that find themselves confronted with a spike in the volume of orders, for instance, are prone to make errors as they scramble to keep up with demand. Human agents can also mistake a set of conditions that indicate fraud in one order for a sign that a subsequent, similar order is fraudulent, even when there is an innocent explanation for why odd conditions exist.

For instance, while fraudsters might ship an order to an address that does not match the order’s billing address so they can take possession of their ill-gotten gains, a shipping and billing address mismatch might also occur because a customer is shipping a gift directly to a loved one.

What are the problems with rules-based systems?

Similar problems can crop up when merchants turn to legacy, rules-based systems that use automation to decline an order when a certain pattern of conditions in an order presents itself. Rules systems often grow in complexity as new rules are added to the system when new red flags are discovered. Over time, the systems become more restrictive — declaring fewer orders to be fraud-free and therefore approving fewer orders overall.

Merchants who rely on manual review and rules-based systems have to constantly adjust how their systems determine what is fraudulent, in an attempt to stay ahead of the perpetrators. When they set the system to be overly cautious about potential fraud, the result can be false declines.

Merchants that use AI-based fraud protection and make ship-or-don’t-ship decisions on vast amounts of data, however, can avoid the leading causes of false declines and substantially reduce their likelihood. The machine-learning models at the heart of such future-focused solutions rely on transaction, behavioral and historic data to separate fraudulent orders from legitimate ones.

How are AI-driven systems different?

“There are over 1,000 features that the model takes into consideration and thousands of data elements within those features,” Jasal Motiram, manager of enterprise customer success at Signifyd, said of the company’s AI-driven fraud-fighting technology.

This means there is not just one factor that determines the risk, but rather a combination of factors, including whether the ordered item is often targeted in fraud schemes; a new shipping address; a recently opened account; mismatches involving credit card CVV numbers; or declined orders that are retried within seconds, faster than a human could retype the necessary information. The machine learning models provide flexibility and make their determinations with significantly more context around each order.

That said, it’s important to understand that fraudsters are aware of some of these factors and constantly evolve their own tactics to try to outsmart the learning model. For that reason the human intelligence and domain expertise that informs the design and education of the machine learning models is a crucial factor in successful fraud protection.

What is the cost of false declines?

False declines cause numerous problems — all of which can lead, ultimately, to increased costs or lost revenue.

In 2021, 451 Research estimated that false declines resulted in merchants losing $16.3 billion a year. And it’s estimated that merchants lose 13 times more money to false declines than they do to true fraud, according to a frequently cited Javelin study.

What are all these costs? To begin with, of course, the merchant loses out on the revenue from the sale that is erroneously tagged as fraud. In some cases, the customer then calls customer service for help, costing the merchant money in the form of staff time.

Overall results 2024 YTD

| Metric | Before decline | After decline | % difference |

| AOV | $274 | $232 | -16% |

| Order Rate | 1.68 | 0.57 | -65% |

| Estimated CLTV | $7,837 | $6,446 | -17% |

But as Signifyd analysis shows, the costs don’t stop there. Among loyal customers — those who have previously had at least three orders approved — a false decline is followed by a 65% decline in the number of orders placed by that customer and a 16% decline in their average order value. Moreover, 27% do not return to the merchant at all — meaning the merchant loses not just that one sale, but a lifetime of potential sales from a repeat customer.

And even those shoppers who return are significantly less valuable as customers. Signifyd’s analysis determined that the lifetime value of returning insulted customers drops by 17%, compared to those customers who were not subject to a false decline.

Why do false declines need to be addressed?

The main reasons merchants should act to prevent false declines are financial: Declining legitimate orders costs money, both in the immediate term and over time.

But in addition to the lost dollars, merchants risk damage to their customer relationships and reputation.

Having a legitimate order declined will make a customer feel — at best — frustrated and likely to shop elsewhere, possibly forever. At worst, customers who feel like they’re being treated as potential criminals may not only give their business to a competitor but may also vent their frustrations to friends or coworkers, or on social media. The damage to the reputation of the brand could be long-lasting – and could translate into even more lost sales, as well as difficulties with employee recruitment and retention.

Seven steps to avoid false declines

Analyze your system’s false declines

The first step to preventing false declines is understanding why your system is mistakenly identifying legitimate orders as fraudulent.

“Categorize your insults, or false declines,” Motiram said. Did the customer call in? Did the risk team review it and decide it was a good order? “Understanding where you’re committing insults can actually allow you to home in on what you need to fix.”

How tackling false declines increases revenue and improves customer experience

The best-in-class fraud teams realize that they are not a defensive force, but rather business optimizers. In this video, Prerit Uppal, Adobe group product manager, payment and risk, explains how focusing on false declines provides the potential to increase revenue and improve the customer experience.

Pinpoint the problem

Analyzing false declines can help determine what changes may lower the false decline rate.

“Maybe you’re getting a lot of insults in a specific way, and you can target that and make changes to decrease them,” Motiram said.

For example, perhaps the analysis uncovers a pattern of false declines on high-value items. Although it’s understandable to have a system set up to give extra scrutiny to more expensive purchases, it’s also possible to be too risk averse. Or the system may be giving too much weight to one factor, such as a shipping address that is different from a billing address.

Adjust the system for accuracy

Fraud detection requires a delicate balance between screening that will reduce the risk of fraud and overzealous reviews of purchases that annoy customers and lead them to abandon their shopping carts — or the entire online store.

Rigorous analysis of the causes of false declines can help merchants adjust the system where needed, without giving up their fraud protection. This could involve changing the weight given to various factors when determining whether an order should be declined, for example, or perhaps creating an additional screening step for suspicious orders before declining them.

How top retailers are addressing false declines

What can be done to lower a merchant’s false decline rate? Some potential solutions are unwieldy and may cause new problems: Merchants may manually review all risky orders, for example, or even call customers to verify their identity. Or they may use a third-party site to verify credit cards. However, all these steps may annoy customers and will cause delays — and customers expect their merchandise to arrive quickly.

To prevent false declines from causing customer dissatisfaction and eating into their profits, top retailers are working with innovative fraud protection companies that use artificial intelligence and machine learning models to more accurately predict which orders are legitimate. This sophisticated technology forms the backbone of a process that can limit false declines:

Review declined orders

Even tracking the number of false declines is more than many merchants do — but it’s a critical first step toward reducing them. It’s worth looking at the bucket of declined orders and choosing some — for example, every order over $500 — for review. This can help determine just how many of these high-value orders were declined in error.

Adjust risk thresholds

If a review turns up certain categories of declined orders that were actually good – for example, it turns out that many of the over-$500 orders should have been approved — it may be worth adjusting the way the system considers these orders. Although high-value orders are still risky, it may be worth taking a bit more risk to make it less likely that a high-spending, legitimate customer will walk away empty-handed.

Consider technology solutions that improve accuracy

Many of the steps to reduce false declines are carried out through automation in the most future-focused fraud solutions. Those solutions — for instance Signifyd’s Commerce Protection Platform — depend on vast amounts of transaction, historical and behavioral data to understand the identity and intent behind each order. The platform analyzes a significantly larger set of signals than legacy systems do to provide the intelligence needed to instantly sort the good from the bad when it comes to online orders, assuring that legitimate customers are not insulted.

Consider apparel brand Philips Electronics. Historically the brand sold through brick-and-mortar stores and other brands’ websites. When Philips started selling directly to consumers online, they were converting only about 40% of their orders, in part because good orders were being turned away, according to Ivone Miranda, Philips consumer experience engagement and care lead. Soon after turning to Signifyd, Philips conversion rate was at 75% and on its way to a better than 90% rate.

Take calculated risks

These reviews and adjustments can lead to an even more systematic approach to understanding false declines: deliberately approving a few orders in a category that would usually be declined, then waiting to see if the orders result in chargebacks. If there are none, that’s a signal that the controls can be loosened.

It’s a strategy that is used by fraud protection vendors such as Signifyd — which also protects the retailers financially from the results of these calculated risks. Signifyd will pay the total cost of fraud for any approved order that turns out to be fraudulent. In essence that creates a “false decline analyzer” that allows it to ship edge cases to determine where legitimacy ends and fraud begins, without putting a merchant’s revenue at risk.

“That’s what Signifyd does to improve performance: We take calculated risks, and we continue to refine the system. If there are no chargebacks, then we adjust the threshold so that we can open up for more approvals,” Motiram said.

Although a merchant could do this on their own, it’s a potentially expensive strategy — which is why many top retailers choose to work with a fraud protection company.

“For a regular mom-and-pop shop or a new ecommerce company, that’s dangerous, because it could become very expensive for them to do that,” Motiram said. “We will reimburse the client if it does become a loss.”

Want to stop leaving money on the table? Let’s talk.